Scarecrow: W-2 Employee

Basic Tax Planning: W-2 and 1040

- The first thing you have to keep in mind and understand is if you are

working as an Employee or an Independent Contractor. There is a BIG

difference between the two. There are advantages and disadvantages to

both. Generally, an employee clocks into work, is trained to do a certain

job, is managed or supervised on daily tasks, and is not responsible for

employment taxes.

- The advantage of being an employee is that all your social security,

Medicare, and withholding taxes are taken out of your paycheck and you

do not have to think about paying taxes. The disadvantage is that you can

generally not deduct any related business expenses like travel and hotels.

- Your W-2 has the information on it to prepare your tax return.

How the W-2 Works

- Your employer will give you a W-2 in January following the prior year of

work. This gives you February through April 15th to file your tax return. The

W-2 has all your wages from each employer and the Federal and State

taxes withheld from your pay to cover your taxes.

- If you have no or little taxes withheld from your W-2 you could owe taxes

when your tax return is prepared! Owing taxes when you don’t expect it

can hurt. It hurts a lot more if you currently don’t have a job to pay it.

- A tax professional can explain to you how to increase your withholding

taxes on your W-2 so you don’t experience this stress. Gather up all your

W-2s.

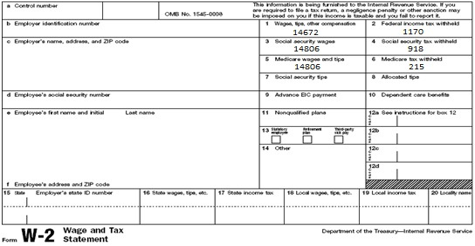

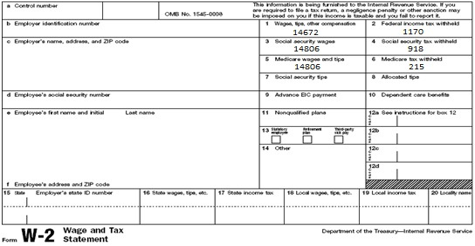

This is What a W-2 Looks Like

- Box 1 is Total Taxable Wages for $14,672 from this one W-2. You could have more

W-2s.

- Box 2 is Federal Income Tax Withheld for $1,170. This is withheld from your

paycheck to cover taxes that might be due when your tax return is prepared.

- There are only a couple of deductions available for a W-2 Employee. 401-K and IRA contributions reduce taxable income. These two items

are deducted from your W-2 to put money away for retirement. It

also means less take home pay.

- Schedule A Itemized deductions add your out-of-pocket medical

expenses, sales tax, property tax, mortgage interest, and charitable

contributions together and compares that amount to your standard

deduction. There are many limitations to each category, so be sure to

discuss this with your tax preparer.

Tinman: 1099 Self-Employed

What if You Are Issued a 1099?

- Take a deep breath because your taxes are a little more difficult than

if you were a W-2 Employee. The 1099 simply means you are an Independent Contractor who is considered Self-Employed. You will be responsible for all of your federal income tax, state income tax, and

social security and Medicare taxes.

- It seems like a lot, but we will walk you down that road of success.

- Good News! You get to deduct all ordinary and necessary business

expenses related to your work. This will reduce the taxes mentioned

above.

What Does a 1099 Look Like?

- The amount on the 1099 is the total income you received from a job

as an Independent Contractor. You may receive a few 1099s and all

that income plus any other income you receive for work (not

reported on a 1099) is included in your Gross Receipts/Sales on your

tax return.

Where Does the 1099 Income Amount go on my Tax Return?

- The 1099 income plus all your work related income is entered on a

Schedule C as part of your 1040 Individual Income Tax Return.

- You are allowed to deduct all ordinary and necessary business

expenses related to earning the income from your work.

What Deductions Can I Take?

Deductions must be business related and documented. Below are a few examples:

- Advertising Expense – Keep your receipts when purchased.

- Telephone – Keep your telephone bills and determine business use vs.

personal use.

- Office Supplies – Keep your receipts when purchased.

- Materials – Keep your receipts when purchased.

- Auto Expenses – Keep actual expenses or mileage. Keep a log of personal

and business mileage.

How Do Taxes Apply?

- The 1099 is for an Independent Contractor. This means that you are the employer.

- You are responsible for all your social security tax, Medicare tax, and your federal

& state income taxes. You have not paid in any money to cover these taxes and

it could equal up to 40% of your total earnings. That can really hurt!

- Your tax professional has a heart and can help guide you through the forest of

expenses that will reduce your taxes. As an Independent Contractor you can

deduct your business expenses. This includes, but is not limited to, travel to get to

worksites, hotels, telephone, headshots, agent fees, etc. Keep your receipts, list

your receipts by type (i.e, hotel, headshots) and total each type of expense for the

year. Congratulations! Organized Stress is less stress.

- The taxes are applied after you deduct all the expenses from your income. This is

called your Net Profit. Lower Net Profit = Lower Taxes

Wicked Witch The Employer

How Being the Employer Works

- If you are employing people like a Production Manager for a bunch of

Actors, then you have to decide if the Actors are W-2 employees or

1099 Independent Contractors

- The safest way to handle this dilemma is to make everyone a W-2

employee. However, this creates more work and costs.

- A good tax professional will help you with this delicate decision, so

you do not get squashed by the IRS and other employment

authorities.

Payroll Taxes

- The employer is required to file payroll tax returns each quarter.

These quarterly tax returns are reported to the IRS on Forms 941. The

Form 941 shows a summary of all the W-2s information like Gross

Wages, Social Security tax withheld from the W-2s, Medicare

withheld from the W-2s, and the federal withholding tax withheld

from the W-2s. In addition, the employer must match the 7.65 % of

employment taxes.

- An IRS Form 940 is required to filed in January for the prior year of

Forms 941 to show gross wages and pay federal unemployment tax.

- There may be State quarterly employment tax returns to file. In

Florida, the State employment tax return is called an RT-6. It collects

State Unemployment taxes.

- Payroll taxes just keep on giving! In January, IRS Form W-3 must be

filed. The W-3 is a summary of all the W-2s.

Drew Ebanks

ADP

321-274-6511

Website: connect.adp.com/drew-ebanks

Lion Starting a New Business

- It's not hard to understand your taxes if you work with a tax

professional that listens to who you are and the needs you have to

reduce stress and anxiety.

- You have the Courage!

- Eating munchkins always makes me feel better before I start a

project.

- Starting a new business is exciting but comes with some stress.

- The following information will help you start your business on the

right foot and reduce your stress.

Business Entities Explained:

- Sole-Proprietors are individuals who operate their business, and that business is not a separate legal entity

from its owner. All income and losses are taxed on the individuals IRS Form 1040. Form 1040 Schedule-C is

used to report income from business operations via a 1099; deductions are also reported on Schedule-C to

determine the net profit for the business. The net profit, if any, will be subject to federal income taxes, and it

also will be subject to social security tax. This is the simplest form of business, with the least amount of

requirements from the owner; however, as net profit increase, the tax liability also increases. The next three

types of entities we will explain are all separate legal entities from their owners.

- Corporations are the most common forms of business structure, and they are chartered by a specific state.

There are two main types of corporations. Subchapter C Corporations pay taxes on Net Profit using IRS Form

1120, and any income distributed to its owners is also taxed on the owners Form 1040. This is known as double

taxation. Subchapter S Corporations use IRS Form 1120S to pass Net Profits to its shareholders via a schedule

K-1, which the shareholder then reports on their individual Form 1040. Generally, a Subchapter S Corporation

is best for an individual or a small group so that they avoid double taxation.

- Partnerships are businesses that include two or more individuals, or companies. A partnership files IRS Form 1065, an informational return, and the Net Profit is treated like a Sole-Proprietorship. Partners receive

Schedule K-1's to report income, or losses on their Form 1040. Partners are also subject to social security tax.

- LLC's are a popular form of organization for businesses. This form of organization evolved in the 1980's to

help limit the downside of a business partnership. LLC's Limit the Liability of its members. Members can only

lose what they initially invested in the company. Be aware that liability may only be limited to a certain degree.

LLC’s can be owned and operated by an individual, or a group of individuals. They can also be taxed in any of

the four ways described here: Sole Proprietor (Form 1040), C-Corp (Form 1120), S-Corp (Form 1120S), or as a

Partnership (Form 1065).

Steps to Organize a Business Entity

- In Florida, a Corporation (C or S) or an LLC must legally organize by filing the Articles of Incorporation or

Articles of Organization, with the Florida Department of Corporations. These Articles usually include rules for

governing the company, owner information, and registered agent information. Florida Law requires a

Registered Agent for contact purposes, and that Agent must have a physical address in Florida. It takes about

three to five business days for the State to process the application. Once approved, you are ready to start

business in Florida.

- After your application is approved, you will have to apply for a Federal Employer Identification Number

through the IRS. Think of this as a social security number for your business. Also, if you wish to be taxed as an

S-Corporation, you must file IRS Form 2553 within 2 ½ months from the date your business was officially

incorporated.

- Our Firm can help you pick which entity will be the best for your business, and personal situation. We prepare

all the documentation required to formally organize a business.

Basic Business Requirements:

Taxes and Licenses

All businesses will have to pay Federal and State Taxes. In Florida, Businesses will be required to pay Federal

Income and Payroll Taxes as well as, State Sales and Use Tax (if applicable) and State Payroll Tax. If you

expect a Net Profit from Business Operations, you are required to submit quarterly estimated tax payments

to the IRS to cover your tax liability for the year. These estimated payments cover both income and payroll

taxes. Federal Payroll Taxes are paid using Form 941 for quarterly tax and Form 940 for yearly

unemployment tax. Florida State unemployment taxes are filed quarterly using Form RT-6. Florida State

Sales Tax is required to be collected if you sell products or provide services subject to Sales Tax. Use Tax

must be paid if you purchase a product to use in your business on which you did not pay sales tax. These two

taxes are usually paid monthly. Most cities and counties require business to obtain business and/or

occupation licenses to operate.

Bookkeeping

All businesses are required to keep adequate books and records of all their income and expenses.

Transactions can be recorded manually or using a computer; however, monthly recording of transactions

should occur to help you manage your business. Income and Expenses can be reported on a Cash Basis.

(Record transaction when cash is physically received or paid out), or on the Accrual Basis (reports income

when earned and expenses when incurred). Some of the required records include: Bank Statements,

Canceled Checks, Check Stubs, Deposit Slips, Sales Invoices, Expense Receipts’, Income Statement, Balance

Sheet, and Statement of Cash Flows.

Dorothy Investment Basics

- Dorothy’s assets just blew away. Oh my! I hope she made some really

good investment decisions so she can rebuild and not be stressed

out. Let’s see if we can help her.

- Her house was a good investment because she can live in it and enjoy

it for many years. Her house value should increase over the years

adding to her overall financial wealth.

- Investments in stocks, bonds, CDs are also a smart choice. Having

some cash on hand for emergencies is part of a solid investment plan.

Start With Safe, Liquid Investments

Low Risk to High-Risk Investments:

- Bank Savings Accounts or Money Market Accounts and CD's possess low risk, as they are insured by the FDIC

up to $250,000; however, the annual return rate for these is about 1% to 4%. These investments are highly

liquid. The counterpoint would be to look at the savings as an emergency fund, and keep in mind what the

current inflation rate is. For example, a savings account earning 1% and inflation is at 3% results in a negative

2% return for the portfolio.

- Municipal Bonds are debt securities issued by governmental agencies to fund capital expenditures such as

roads, and schools. These bonds are typically tax exempt as well. They possess low risk because governments

can raise taxes to overcome any shortcomings. Municipal bond rates of return vary depending on the

economy; 3-4% currently. These bonds should be purchased as long-term investments. The two types of

municipal bonds are general obligation, repaid via the general operating funds, and revenue bonds which are

supported by the project in which they are being raised for.

- Corporate Bonds are debt issued by a corporation to gain more capital for growth. They can be insured via a

third party. Investors can earn about a 4% rate of return. Bond values fluctuate in the opposite direction of

interest rates. Not all bonds are created equal. They range from a credit risk of AAA to high yield, or junk

bonds. Key points to look for in making a bond purchase are quality, coupon, price, yield, and maturity date.

- Annuities come in three types. Fixed annuities have a fixed interest rate during the hold period, and a known

maturity date. Principal investment is usually not at risk. Indexed annuities are a type of fixed annuities that

mirror market performance without being in the market. Thus, your principal is protected from any downside

losses, and you may be able to experience some upside potential greater than a fixed interest rate. Variable annuities are invested in the market and offer death benefits, and tax deferred growth. Due to these features,

they have higher fees and internal expenses.

- Stocks are shares of public corporations bought by the general public. Stocks are high risk, high return

investments. Some companies are considered blue chip companies. Investing in shares of blue-chip

companies are seen to be a “safer” investment, because the company is well established and known. The

stock market usually experiences a rate of return of around 5–15% per year in the long run.

- Exchange Traded Funds (EFT) are much like stocks in that they are liquid investments and can be traded

throughout the course of the day. They also provide diversification like mutual funds; however, their internal

fees are less than mutual funds.

- Mutual Funds are investment pools that include stock and bonds. These pools are managed by money

managers who control when the securities are bought and sold. They offer great diversification, and the similar

rates of return as stocks. Because investors monies are pooled together, the values of the funds are

determined each day after the market closes and are not liquid during the day.

- Alternatives are non-wall street stock and bond type investments. They generally are not correlated to the

stock or bond market, and they are not liquid investments. Preferred alternatives fall under the guidelines and

supervision of the FINRA 1040 Mutual Fund Act. Some common types of alternative investments are known as

Business Development Corporations or Real Estate Investment Trusts. They may offer an above average rate of

return of current interest rates. Current distribution rates for alternative investments range from 5 – 7% and

the average holding period is from 5-7 years. Key points to consider in making an alternative investment

purchase are: diversification within the investment, distribution rates, collateral, and an exit strategy.

- Private Investments are usually venture investments to start a new business. You should only invest with

people whom you know and trust. There are many gimmicks out there to trick people into believing that they

will make money if they invest.

Investment Terminology

- Blue Chip: Nationally recognized, well established, financially sound company. Safer, less

volatile investments

- Broker: Firm that charges a commission to execute trades

- Capital Gain: Increase in value of an investment (capital asset)

- Dividend: Portion of company's earning distributed to shareholders

- FDIC: Federal Deposit Insurance Corporation

- Liquidity: Degree to which an asset can be converted to cash

- Long Term/Short Term: More than one year/Less than one year

- Portfolio: Variety of investments held by an individual or firm

- Return: Gain or loss on an Investment in a particular period

- Risk: How much potential for gain or loss

David LLewellyn

WV Wealth Management

386-259-3781

Website: wvwealthsolutions.com